DBL Partners’ Managing Partner, Nancy Pfund and co-author Katie Plichta landed in today’s RenewableEnergy.com with a timely byline in support of clean-energy subsidies. Energy initiatives have been a staple in our country’s growth for more than 200 years. It’s time to extend thinking along conventional lines like coal and natural gas to renewables. This is something both Democrats AND Republicans have gotten behind, and the good clean energy projects does for the country is too significant to ignore. The original article can be found here.

Despite overwhelming evidence that the growth of the clean tech industry benefits workers in red and blue states alike — Texas alone employs more clean tech workers than there are coal workers in the entire country — some in Washington still argue that clean tech subsidies are a market distortion that America cannot afford.

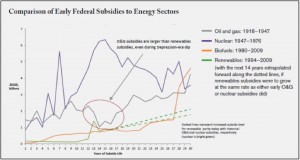

Such opponents forget that America’s support for energy innovation has helped drive our country’s growth for more than 200 years. A recent report I co-authored with Ben Healey — “What Would Jefferson Do?” — shows how current renewable energy subsidies compare to the historical norm for emerging sources of energy:

- As a percentage of inflation-adjusted federal spending, nuclear subsidies accounted for more than 1 percent of the federal budget over their first 15 years. Oil and gas subsidies made up 0.5 percent of the total budget. Renewable subsidies, in contrast, have constituted only about 0.1 percent.

- In inflation-adjusted dollars, nuclear spending averaged $3.3 billion over the first 15 years of subsidy life. O&G subsidies averaged $1.8 billion. Renewables averaged less than $0.4 billion.

Recognizing the power of energy innovation to create high quality jobs, prominent Republican governors have pushed politics aside to champion clean tech. Former Governor Haley Barbour of Mississippi, for example, was called by the New York Times “the driving force” behind Mississippi’s endeavors to become a clean tech leader. Republican Governor Chris Christie of New Jersey not only mandated solar purchases by state utilities, but he also signed a law calling for the percentage of power derived from solar in the state to double. At the time of signing he said “Having renewable energy in our state, having it be a larger part of our portfolio, creating jobs, is not a Republican issue or Democratic issue. It’s an issue that the people of our state demand we work on together.”

Clean tech innovation benefits everyone, but for clean tech to survive, certain policies supporting long-term investment in clean tech must be implemented at both the federal and state levels:

- The Solar Investment Tax Credit (ITC) must remain in place or be phased out gradually, rather than dropping off a cliff in 2016.

As a 30 percent tax credit on solar systems for both commercial and residential properties, the ITC has greatly contributed to the 76 percent growth rate the solar industry has experienced since 2006. Despite its importance, the ITC faces automatic reduction to 10% at the end of 2016. Such a steep and sudden drop would disrupt the solar industry’s steadily improving economics relative to other, also subsidized, energy sources.

- Tax legislation should be redrafted to permit clean tech-related Master Limited Partnerships and solar REITs, to level the playing field with oil, gas and coal investments.

The tax code should permit the formation of Master Limited Partnerships (MLPs) — a publicly traded corporate structure that is taxed like a partnership — for energy portfolios owning and financing renewable energy and biofuel projects. MLPs are already permitted for portfolios consisting of oil, gas and coal investments, so it’s time to level the playing field and lower the cost of financing clean energy projects. The proposed solution, the “MLP Parity Act” (S.3275), died in committee last year, but it is likely to be reintroduced. Similarly, an expansion of the definition of Real Estate Investment Trusts (REITs) to include solar installations as a form of real property would greatly expand the pool of capital available for solar projects.

- The Production Tax Credit should be extended on a longer term basis.

Federal policies drive private investment many times over. The Production Tax Credit (PTC) is a prime example. The PTC has played a crucial role in the development of wind energy in the U.S. since its inception in 1992, yet Congress has allowed the PTC to sunset four times. According to the American Wind Energy Association, 60 percent of a wind turbine’s value is now produced in America, compared to 25 percent prior to 2005. While the credit survived the fiscal cliff, wind investors were left skittish while debates carried on in Washington. In extending the credit, 75,000 wind power jobs were saved. The extension gave certainty and security to the wind power industry, but not much, since the PTC is due to expire again at the end of this year. A longer term plan for this important industry is needed.

Red and blue states alike benefit from the development of clean tech. Legislators at the state level have realized this and many have taken up the flag of promoting clean tech within their jurisdiction. The industry still faces severe challenges though, and federal policy is needed to drive energy innovation forward, a role it has played for centuries.

Nancy Pfund is a Managing Partner of DBL Partners, a “Double Bottom Line” venture capital firm based in San Francisco. Katie Plichta is a JD/MBA candidate at Stanford University and currently with DBL Partners as a Stanford GSB Impact Labs Associate.

Hear Nancy Pfund speak during the plenary session of Solar Power-Gen, taking place on February 14th, 2013 in San Diego. More information about the show can be found here.